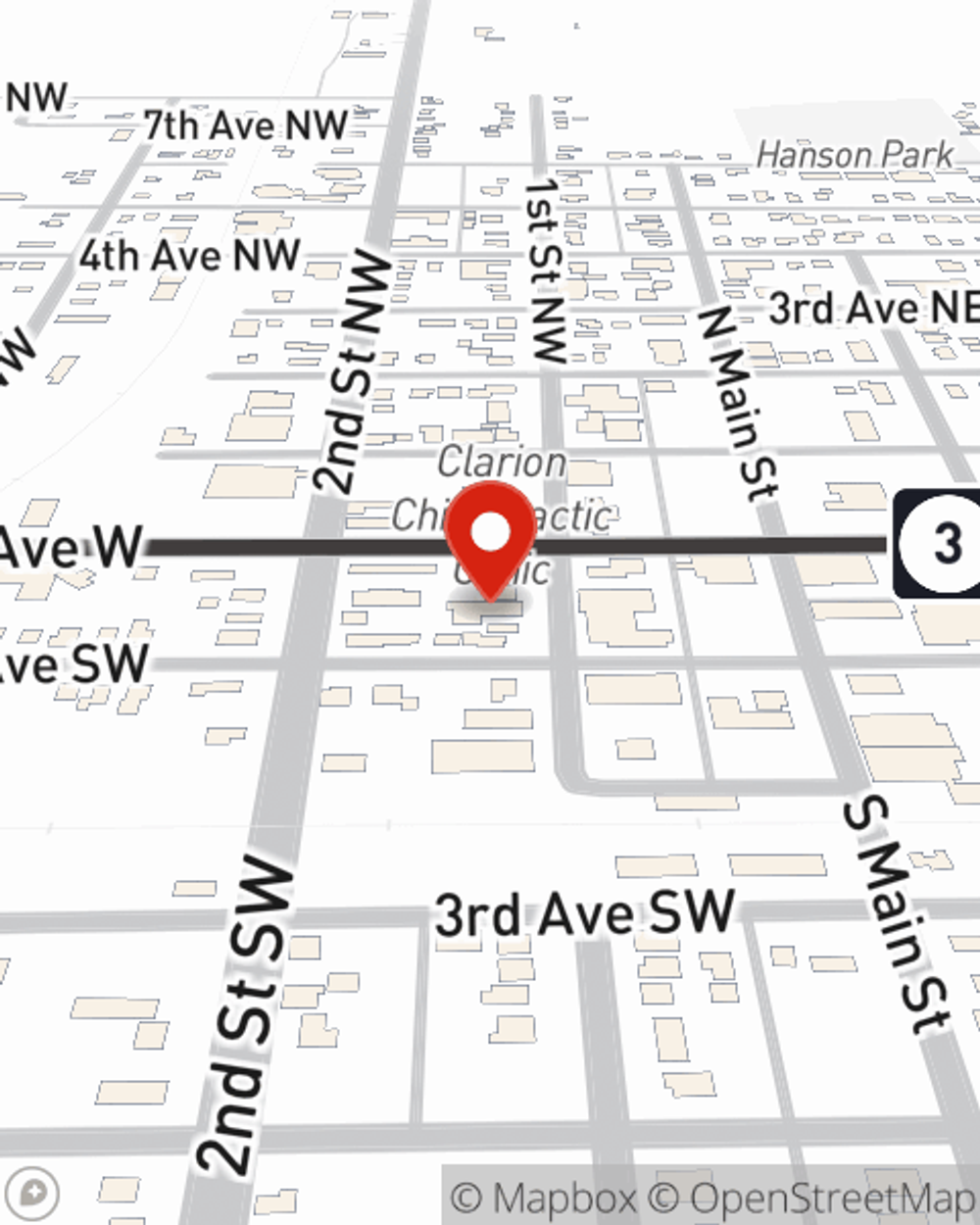

Business Insurance in and around Clarion

One of Clarion’s top choices for small business insurance.

No funny business here

- Hampton

- MINNESOTA

- SOUTH DAKOTA

- NEBRASKA

- IOWA

Help Prepare Your Business For The Unexpected.

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

One of Clarion’s top choices for small business insurance.

No funny business here

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, surety and fidelity bonds or builders risk insurance.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Holly Narber's team to discover the options specifically available to you!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Holly Narber

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?